Understanding the Importance of BUSINESS CREDIT BUILDER Programs

When it comes to establishing a solid financial foundation for your business, one crucial aspect to consider is building a strong credit profile. A business credit builder program can be the key to unlocking various opportunities and benefits for your company.

The Benefits of Business Credit Builder

business credit builder accounts are essential for businesses looking to access financing options, secure better loan terms, and establish credibility with vendors and suppliers. Here are some key benefits of utilizing a BUSINESS CREDIT BUILDER program:

- Improved Access to Financing: A strong business credit profile can increase your chances of qualifying for loans and lines of credit.

- Better Loan Terms: With a positive credit history, you may be eligible for lower interest rates and more favorable loan terms.

- Vendor Relationships: Establishing business credit can help build trust with suppliers and vendors, leading to more favorable payment terms.

- Growth Opportunities: Building a solid credit profile opens up opportunities for business expansion and growth.

How BUSINESS CREDIT BUILDER Programs Work

BUSINESS CREDIT BUILDER companies offer various services to help businesses establish and improve their credit profiles. These services may include:

- business credit builder card: A dedicated credit card tailored to help you build your business credit.

- business credit builder loans: Loans designed to be accessible for businesses looking to establish credit.

- Business Credit Builder Tradelines: Adding positive payment history to your business credit report.

- Business Credit Building Services: Professional assistance in navigating the complexities of business credit building.

Frequently Asked Questions about Business Credit Builders

Here are answers to some common questions that businesses have about business credit builders:

1. What is the Importance of Business Credit for Small Businesses?

Establishing business credit is crucial for small businesses as it helps separate personal and business finances, builds credibility, and enables access to financing.

2. How Long Does It Take to Build Business Credit?

The time it takes to build business credit varies, but consistently utilizing credit and making timely payments can expedite the process.

3. Can I Build Business Credit with a Limited Budget?

Yes, there are cost-effective ways to start building business credit, such as obtaining a business credit card and managing it responsibly.

4. Do Business Credit Builders Guarantee Approval for Loans?

No, while business credit builders can improve your credit profile, loan approval ultimately depends on various factors, including the lender’s criteria.

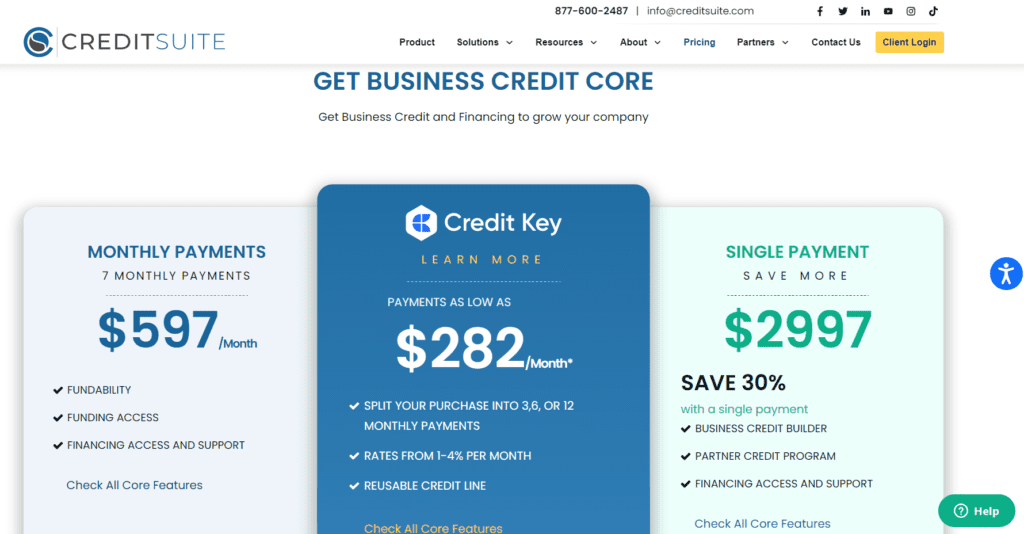

5. Are Business Credit Builders Worth the Investment?

For many businesses, the benefits of accessing better financing options and improving creditworthiness make investing in a business credit builder program worthwhile.

Conclusion

Building a strong business credit profile is essential for the long-term success and growth of your company. By leveraging the services provided by BUSINESS CREDIT BUILDER programs, you can establish a solid financial foundation and unlock a world of opportunities for your business.